The Ultimate Guide To Ryan Lavergne Real Estate

Table of ContentsRyan Lavergne Real Estate Can Be Fun For AnyoneRyan Lavergne Real Estate - The FactsRyan Lavergne Real Estate Can Be Fun For AnyoneGetting My Ryan Lavergne Real Estate To Work

For contrast, Wealthfront's average portfolio made simply under 8% net of costs over the past eight years. And also the Wealthfront return is even more tax reliable than the return you would get on property because of the way returns on your Wealthfront profile are taxed as well as our tax-loss harvesting.1% return, you require to have a nose for the communities that are most likely to value most quickly and/or locate an extremely mispriced residential property to purchase (right into which you can invest a little quantity of cash as well as upgrade into something that can regulate a much greater rent even better if you can do the job yourself, but you require to make certain you are being effectively made up for that time).

And we're speaking regarding people that have big teams to aid them find the suitable residential or commercial property and also make enhancements. It's far better to diversify your financial investments You need to consider buying a private home similarly you must think of a financial investment in a specific supply: as a huge danger - ryan lavergne real estate.

The suggestion of trying to pick the "right" specific residential property is alluring, especially when you think you can get a good deal or acquire it with a great deal of utilize. That strategy can work well in an up market. Nonetheless, 2008 educated all of us concerning the threats of an undiversified property portfolio, and reminded us that utilize can function both methods.

Indicators on Ryan Lavergne Real Estate You Need To Know

Liquidity matters The last significant argument against possessing investment properties is liquidity. Unlike a realty index fund, you can not offer your home whenever you desire. It can be difficult to predict for how long it will consider a house to sell (and also it typically seems like the a lot more anxious you are to sell, the longer it takes) (ryan lavergne real estate).

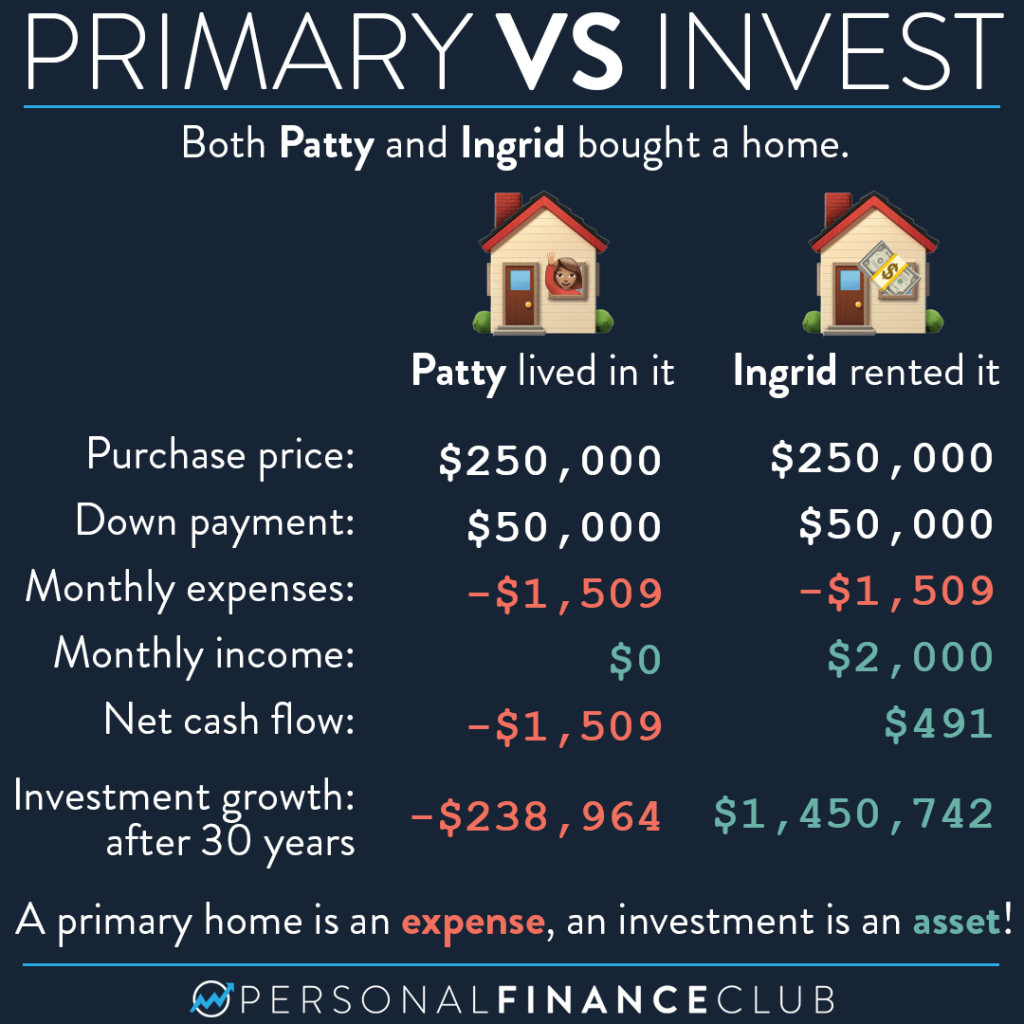

Attempting to make 3% to 5% even more than you would certainly on your index fund is nearly difficult other than for a handful of genuine estate personal equity financiers who attract the best and the brightest to do nothing but focus on exceeding the market., you should not treat your residence as a financial investment, so you don't have to limit your equity in it to 10% of your liquid internet worth).

However, if you own a residential property that rents out for less than your carrying cost, after that I would highly advise you to think about selling the residential property as well as instead invest in a varied portfolio of inexpensive index funds.

For many years, real estate financial investment has actually constantly skyrocketed. Some individuals select to acquire a residential property to rent on a long-term basis, while others choose short-term services for travelers as well as organization tourists. One area that has seen massive growth in realty investment is Las Las vega. From houses, single-family residences, as well as penthouses to commercial offices and retail areas, the city has a variety of buildings for budding financiers.

Fascination About Ryan Lavergne Real Estate

So, is Las Vegas realty an excellent financial investment? Allow's discover! Why Las Las Vega is a Wonderful Place to Spend in Property, A whole lot of people are relocating to Las Las vega whether it's due to the remarkable weather, no earnings taxes, and also a wonderful cost of living. That's why the city is continuously coming to be a top property financial investment destination.

In between the well known Strip, the wealth of hotels, hotels, and casinos, world-class entertainment, extraordinary interior tourist attractions, as well as remarkable outdoor areas, people will constantly be attracted to the city. This implies you're never brief of site visitors trying to find a place to stay for a weekend journey, a long-term service, or a residence to relocate to.

Likewise, Las Vegas is understood for its service conventions ryan lavergne real estate and also trade convention that it holds annually. These bring in organization vacationers and also business owners from all profession who, again, will certainly be looking for somewhere to stay. Having a genuine estate home in the area will be valuable for them as well as gain returns for you.

You can expect a constant stream of people looking to rent out acquisition, also your Las Vegas real estate investment. What to Try to find in an Excellent Financial Investment Residential Property, Buying real estate is a major life choice. To identify if such an investment benefits you, make sure to take into consideration these important points.

The smart Trick of Ryan Lavergne Real Estate That Nobody is Discussing